Energy Consumption of Crypto Mining: Consequences and Sustainable Solutions Using Systems Thinking and System Dynamics Analysis

Abstract

1. Introduction

2. Methods

Main Data Used in the Model

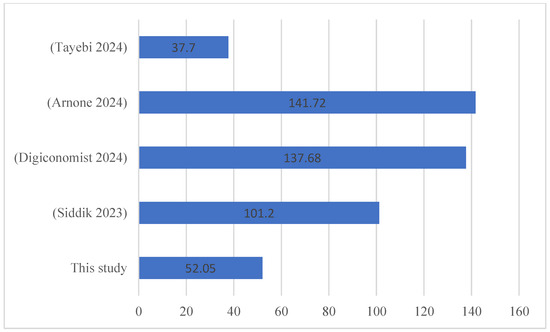

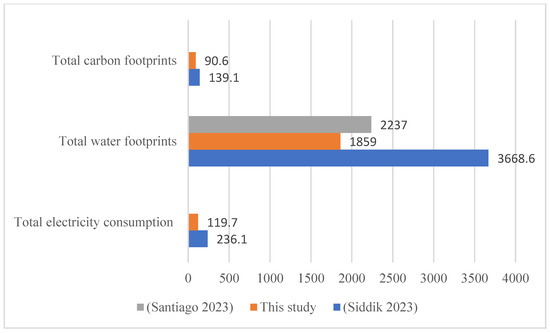

3. Results and Discussion

3.1. System Dynamics Analysis

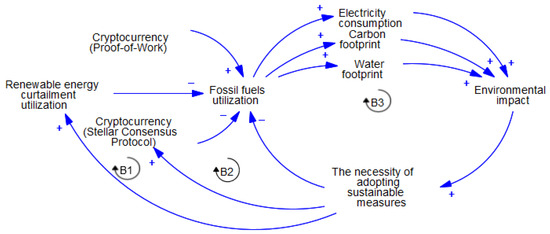

3.2. Systems Thinking Analysis

3.3. Proposed Sustainable Solutions

3.3.1. Renewable Energy Curtailment

3.3.2. Stellar Consensus Protocol

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Siddik, M.A.B.; Amaya, M.; Marston, L.T. The water and carbon footprint of cryptocurrencies and conventional currencies. J. Clean. Prod. 2023, 411, 137268. [Google Scholar] [CrossRef]

- Rejeb, A.; Rejeb, K.; Keogh, J.G. Cryptocurrencies in modern finance: A literature review. Etikonomi 2021, 20, 93–118. [Google Scholar] [CrossRef]

- Rodima-Taylor, D.; Grimes, W.W. Cryptocurrencies and digital payment rails in networked global governance: Perspectives on inclusion and innovation. In Bitcoin and Beyond; Routledge: London, UK, 2017; pp. 109–132. [Google Scholar]

- Pantin, L.P. Financial Inclusion, Cryptocurrency, and Afrofuturism. Northwestern Univ. Law Rev. 2023, 118, 621–690. [Google Scholar]

- Barreto, P.I.B.; Maggia, P.J.A.U.; Acevedo, P.S.I. Cryptocurrencies and blockchain in tourism as a strategy to reduce poverty. Retos 2019, 9, 18. [Google Scholar]

- Scott, B. How Can Cryptocurrency and Blockchain Technology Play a Role in Building Social and Solidarity Finance? UNRISD Working Paper; UNRISD: Geneva, Switzerland, 2016. [Google Scholar]

- Herlihy, M.; Moir, M. Enhancing accountability and trust in distributed ledgers. arXiv 2016, arXiv:1606.07490. [Google Scholar]

- Anusha, R. Blockchain Technology for Supply Chain, Health Care, Intellectual Property Rights, E-voting. Turk. J. Comput. Math. Educ. (TURCOMAT) 2021, 12, 1873–1878. [Google Scholar]

- Ahmad, M.S.; Shah, S.M. Moving beyond the crypto-currency success of blockchain: A systematic survey. Scalable Comput. Pract. Exp. 2021, 22, 321–346. [Google Scholar] [CrossRef]

- Schueffel, P. DeFi: Decentralized Finance-An Introduction and Overview. J. Innov. Manag. 2021, 9, I–XI. [Google Scholar] [CrossRef]

- Cumming, D.J.; Johan, S.; Pant, A. Regulation of the crypto-economy: Managing risks, challenges, and regulatory uncertainty. J. Risk Financ. Manag. 2019, 12, 126. [Google Scholar] [CrossRef]

- Arsi, S.; Ben Khelifa, S.; Ghabri, Y.; Mzoughi, H. Cryptocurrencies: Key risks and challenges. In Cryptofinance: A New Currency for a New Economy; World Scientific: Singapore, 2022; pp. 121–145. [Google Scholar]

- Wendl, M.; Doan, M.H.; Sassen, R. The environmental impact of cryptocurrencies using proof of work and proof of stake consensus algorithms: A systematic review. J. Environ. Manag. 2023, 326, 116530. [Google Scholar] [CrossRef]

- Islam, M.R.; Rashid, M.M.; Rahman, M.A.; Mohamad, M.H.S.B. A comprehensive analysis of blockchain-based cryptocurrency mining impact on energy consumption. Int. J. Adv. Comput. Sci. Appl. 2022, 13. [Google Scholar] [CrossRef]

- Krause, M.J.; Tolaymat, T. Quantification of energy and carbon costs for mining cryptocurrencies. Nat. Sustain. 2018, 1, 711–718. [Google Scholar] [CrossRef]

- Chohan, U.W. Cryptocurrencies: A Brief Thematic Review. 2022. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3024330 (accessed on 1 September 2024).

- Bevand, M. Serious faults in Digiconomist’s Bitcoin Energy Consumption Index. 2017. Available online: http://blog.zorinaq.com/serious-faults-in-beci (accessed on 22 January 2024).

- Digiconomist. Bitcoin Energy Consumption Index. Available online: https://digiconomist.net/bitcoin-energy-consumption#validation (accessed on 22 January 2024).

- Globalpetrolprices. Electricity Prices. Available online: https://www.globalpetrolprices.com/electricity_prices/ (accessed on 22 January 2024).

- Tetiana, Z.; Volodymyr, S.; Oleksandr, D.; Vasyl, B.; Tetiana, D. Investment Models on Centralized and Decentralized Cryptocurrency Markets; Scientific Bulletin of National Mining University: Kyiv, Ukraine, 2022. [Google Scholar]

- Makarov, I.; Schoar, A. Cryptocurrencies and decentralized finance (DeFi). Brook. Pap. Econ. Act. 2022, 2022, 141–215. [Google Scholar] [CrossRef]

- Arnone, G. The Future of Cryptocurrencies and Digital Currencies. In Navigating the World of Cryptocurrencies: Technology, Economics, Regulations, and Future Trends; Springer: Berlin/Heidelberg, Germany, 2024; pp. 103–111. [Google Scholar]

- Tayebi, S.; Amini, H. The flip side of the coin: Exploring the environmental and health impacts of proof-of-work cryptocurrency mining. Environ. Res. 2024, 252, 118798. [Google Scholar] [CrossRef] [PubMed]

- Santiago, N.G.; Gonzales, A.L.; Damilig, A.D. Minding Modern Mining: An Analysis of the Energy-Intensiveness of Proof-of-Work Consensus Mechanism and its Violation Against the Right to a Balanced & Healthful Ecology. J. ReAttach Ther. Dev. Divers. 2023, 6, 1250–1276. [Google Scholar]

- Siddique, I.; Smith, E.; Siddique, A. Assessing the sustainability of bitcoin mining: Comparative review of renewable energy sources. J. Altern. Renew. Energy Sources 2023, 10, 46610. [Google Scholar] [CrossRef]

- de Vries, A. Bitcoin’s growing water footprint. Cell Rep. Sustain. 2024, 1, 100004. [Google Scholar] [CrossRef]

- Azar, A.T. System dynamics as a useful technique for complex systems. Int. J. Ind. Syst. Eng. 2012, 10, 377–410. [Google Scholar] [CrossRef]

- Norway, I. Conversion Guidelines—Greenhouse Gas Emissions. Available online: https://www.eeagrants.gov.pt/media/2776/conversion-guidelines.pdf (accessed on 23 January 2024).

- UC. Cambridge Bitcoin Electricity Consumption Index. Available online: https://ccaf.io/cbnsi/cbeci (accessed on 23 January 2024).

- Gallersdörfer, U.; Klaaßen, L.; Stoll, C. Energy consumption of cryptocurrencies beyond bitcoin. Joule 2020, 4, 1843–1846. [Google Scholar] [CrossRef]

- Laimon, M.; Goh, S. Unlocking potential in renewable energy curtailment for green ammonia production. Int. J. Hydrogen Energy 2024, 71, 964–971. [Google Scholar] [CrossRef]

- Laimon, M.; Yusaf, T. Towards energy freedom: Exploring sustainable solutions for energy independence and self-sufficiency using integrated renewable energy-driven hydrogen system. Renew. Energy 2024, 222, 119948. [Google Scholar] [CrossRef]

- Network, P. The First Digital Currency You Can Mine on Your Phone. Available online: https://minepi.com/ (accessed on 23 January 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Laimon, M.; Almadadha, R.; Goh, S. Energy Consumption of Crypto Mining: Consequences and Sustainable Solutions Using Systems Thinking and System Dynamics Analysis. Sustainability 2025, 17, 3522. https://doi.org/10.3390/su17083522

Laimon M, Almadadha R, Goh S. Energy Consumption of Crypto Mining: Consequences and Sustainable Solutions Using Systems Thinking and System Dynamics Analysis. Sustainability. 2025; 17(8):3522. https://doi.org/10.3390/su17083522

Chicago/Turabian StyleLaimon, Mohamd, Rula Almadadha, and Steven Goh. 2025. "Energy Consumption of Crypto Mining: Consequences and Sustainable Solutions Using Systems Thinking and System Dynamics Analysis" Sustainability 17, no. 8: 3522. https://doi.org/10.3390/su17083522

APA StyleLaimon, M., Almadadha, R., & Goh, S. (2025). Energy Consumption of Crypto Mining: Consequences and Sustainable Solutions Using Systems Thinking and System Dynamics Analysis. Sustainability, 17(8), 3522. https://doi.org/10.3390/su17083522